CECL – The New Credit Loss Standard

By Nathan Schouest, Assurance & Advisory Partner

at Frank, Rimerman + Co. LLP

What Does Your Business Need to Know?

In response to the financial crisis of 2007-2009, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-13, Financial Instruments – Credit Losses (Topic 326) Measurement of Credit Losses on Financial Instruments. The ASU was codified in the accounting standards as ASC Topic 326, Financial Instruments – Credit Losses. After a number of amendments and deferrals, public entities have had to comply with Topic 326 since 2020 and the implementation date for nonpublic entities, including nonprofit entities, is for financial reporting years beginning on January 1, 2023 and later.

Prior to Topic 326, credit losses using an “incurred loss” method were recognized only when a loss was probable, which delayed recording credit losses even when the loss may be expected. Topic 326 introduces the “current expected credit loss” method, or “CECL” . The new model is broad in scope and will apply to most financial assets carried at amortized cost and certain other financial instruments.

Some of the financial instruments within the scope of Topic 326 that we typically see impacting our clients include:

• Receivables from revenue transactions with customers, including trade receivables

• Loan and note receivables

• Debt securities classified as “held-to-maturity”

• Certain cash equivalents

• Net investments in leases for lessors

Topic 326 does NOT apply to:

• Financial instruments measured at fair value

• Promises to give (pledges) for nonprofit entities

• Participant loans in defined contribution employee benefit plans

• Receivables between entities under common control

What Do You Do First?

To implement the new standard, management will need to develop an estimate of the collectability of the reported amounts of its financial assets. In doing so, reporting entities should develop a written policy and during each recognition period consider the following factors in measuring credit losses:

• Relevant historical information

• Current conditions and events

• Reasonable and supportable forecasts

There is no prescribed method required by the accounting guidance and estimating credit losses can be very subjective. The first steps will be to inventory your financial assets that are within the scope of Topic 326 (third paragraph above), and gather the relevant historical information related to these instruments as a foundational starting point.

What Do You Do Next?

Building on the historical information unique to your entity’s financial assets, management should consider current conditions, fact patterns and events applicable to your specific circumstances and apply that information to the estimate of expected credit losses, as previously done in the past under the “incurred loss” method. In addition to the evaluation of current market, industry and customer conditions, management must now consider reasonable and supportable forecasts of market and industry conditions in determining what credit loss to recognize and what liabilities may be required to be recorded under Topic 326. The conclusion by management of “expected” credit losses may indicate an increase, a decrease or static rate of reserve compared to historical measurements.

Topic 326 does not expect management to create its own economic forecasts to support the collectability of its financial assets. Consideration should be given to available information relevant to the collectability of the assets including internal and external, and both qualitative and quantitative factors. The FASB believes an entity can leverage its current systems or methods for recording an allowance for credit losses, although the inputs used will now have to include forward looking information management finds relevant to its circumstances under the CECL model.

Estimated losses should be recorded through an allowance for credit losses account that is netted against the recorded assets. Per ASC 326-20-30-1, “the allowance for credit losses is a valuation account that is deducted from the amortized cost basis of the financial asset(s) to present the net amount expected to be collected on the financial asset.” The estimate is measured and recorded at the initial recognition of the financial instrument. At each reporting period, the entity should update its estimate and adjust the allowance based on the current estimate. The measurement of credit losses will be recorded in operations for new financial assets acquired during the period and the expected increase or decrease in credit losses taking place during the period for financial assets recorded in previous periods.

Do We Evaluate Everything at the Financial Statement Line-Item Level the Same Way?

Topic 326 allows management to measure expected credit losses on a collective (pool) basis when financial assets have similar risk characteristics. Common pools to consider include delinquency rates, aging of assets, default rates, credit ratings, asset types, historical credit loss patterns, customer sizes and financial terms, geographical locations, and industries.

The pools must be revisited each reporting period to determine if the historical loss rates in the pools should be adjusted based upon current conditions or characteristic changes. If there are changes to financial assets that no longer share characteristics within the pool they have been historically evaluated with, the assets should be measured individually. Additionally, if there are financial assets that cannot be pooled with other assets at initial recognition, they also should be evaluated on an individual basis.

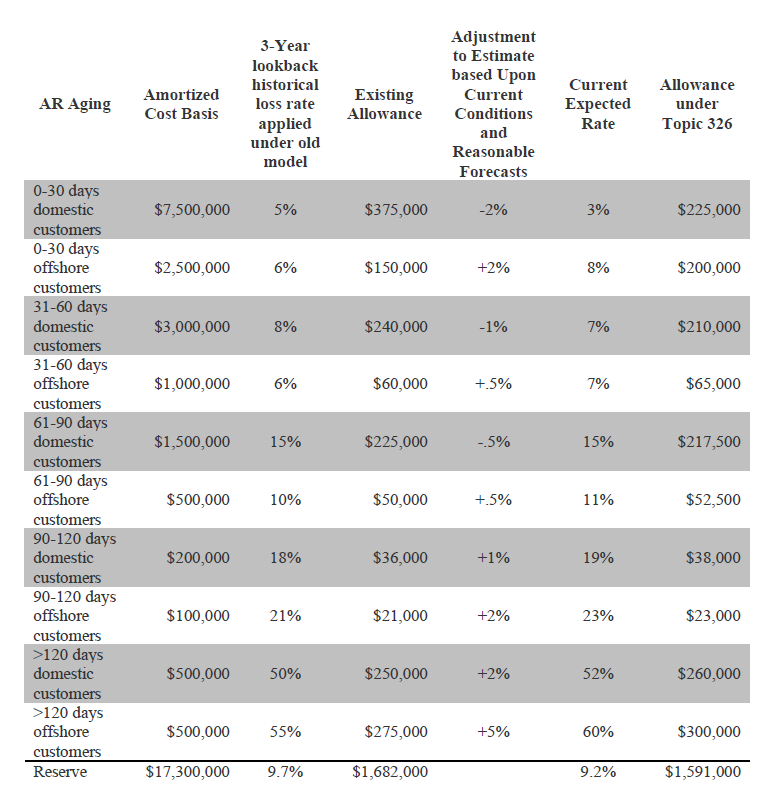

An illustrative example of how you may evaluate your trade receivables when applying topic 326:

How Will This Impact My Current and Comparative Financial Statements?

The new standard will apply to all existing scoped-in financial assets at the adoption date and all future assets acquired. Topic 326 is accounted for on a modified retrospective basis with a cumulative impact adjustment recognized through retained earnings (or net assets for nonpublic entities) on the adoption date; therefore, previous reporting periods will not be impacted. The standard requires transition year disclosures in the year of adoption as well as ongoing disclosures.

Transition Year Disclosures:

• The nature of the change in the accounting principle

• The method of applying the change

• The effect of the adoption on any line item in the statement of financial position

• The cumulative effect of the change on retained earnings (or net assets) or other components of equity, such as comprehensive income (loss)

Ongoing Disclosures – expanded disclosures:

• Entities are free to determine the level of detail that should be disclosed based upon the facts and circumstances. Disclosures should include the policies for evaluating current expected credit losses to the financial statements applicable for the entity, including how management evaluates, recognizes and accounts for its reserves and liabilities.

Are There Any Practical Expedients?

Topic 326 provides practical expedients to simplify the estimate of credit losses on certain financial assets supported by collateral.

Collateral-dependent financial assets:

Can be applied to a financial asset if (1) the borrower is experiencing financial difficulty; and (2) repayment is expected to be provided substantially through the sale or operation of the collateral.

Collateral maintenance provisions:

Can be applied for assets secured by collateral when the amount of collateral is continually adjusted as a result of changes in the fair value of the collateral.

Key Takeaways

Don’t delay – The transition to Topic 326 will require gathering relevant historical information, and determining what, if any, pooling characteristics should be considered when applying the standard to your interim and year end 2023 financial statements. In addition, management will need to determine what forecasts are reasonable and supportable to its financial assets when measuring expected credit losses.

Seek help – Topic 326 has been in place for public companies for three years and the takeaway from their transitions was the effort was bigger than anticipated. As a private business, we understand there are competing priorities and resource constraints. However, reviewing disclosures on credit losses in financial statements for public companies within your industry can provide guidance and may help streamline the adoption process. We are available to help discuss your potential needs for this transition.

How Can We Help?

We can leverage our detailed knowledge of your business operations, products and services, contracts, accounting policies and procedures, personnel resources, and accounting system capabilities to help you navigate your transition to Topic 326.

Contact Us

Nathan Schouest

Assurance & Advisory Partner

E-mail

LinkedIn